From Field to Fuel: The Strategic Role of Soybean Oil in the New Energy Era

- Vanderlei Cadore

- Aug 27, 2025

- 3 min read

How biodiesel policies in Brazil and the U.S. are reshaping the global agricultural market.

Soybean oil, once considered a byproduct of crushing aimed at producing meal for animal feed, has become a key player in a new energy era. The rise of biofuels in both the United States and Brazil is quietly transforming the production and trade matrix of soybeans.

The New Role of Soybean Oil

With the advancement of renewable fuel policies, soybean oil now adds more value per bushel than ever before. This shift has elevated the concept of oilshare—the share of oil in the total crushing value—to a strategic level. Today, oil is as important as meal in determining soybean value.

In the U.S., the EPA’s proposal to increase biomass-based diesel volumes for 2026 and 2027 reinforces this trend. In Brazil, the National Energy Policy Council (CNPE) approved a gradual increase in the mandatory biodiesel blend in diesel, reaching 15% (B15) by 2026.

Oilshare in the U.S.: Charts That Reveal Market Shifts

In the United States, the soybean oilshare concept is widely used to measure the share of soybean oil in the total crush value. This metric has gained relevance with the growth in demand for biofuels and the appreciation of oil relative to meal.

The charts provided by CME Group accurately illustrate this evolution. They show:

The weekly share of soybean oil in the value of the soybean complex (Soybean Oilshare Weekly Nearby).

The volatility of oil and meal prices over time.

The direct impact of policy changes, such as the transition from the 40A to 45Z credit, on soybean oil demand.

Oilshare in Brazil: A Developing Indicator

In Brazil, there is still no official indicator equivalent to the American soybean oil share. However, it is possible to monitor the evolution of soybean oil's share of the crushing value through a comparative chart, using public and private data.

Monitoring sources:

Component | Suggested Source | Frequency |

Soybean oil price | CEPEA / ANP / StoneX | Daily/Weekly |

Soybean meal price | CEPEA / StoneX | Daily/Weekly |

Crushing volume | ABIOVE / ANP / IBGE | Monthly |

Biodiesel production | ANP | Monthly |

Oil/meal exports | SECEX / MDIC | Monthly |

Domestic/export premiums | Brokers / private platforms | Weekly |

Impacts on Production and Trade

These changes have led to a sharp increase in domestic soybean oil consumption in both Brazil and the USA, resulting in:

Lower export availability

Higher domestic market value

Increased internal premiums, albeit quietly

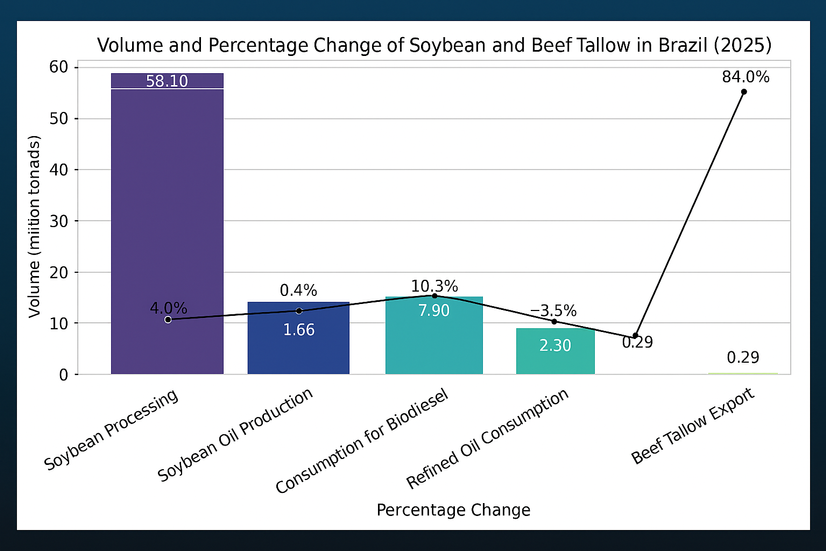

StoneX projects a 10%+ increase in soybean oil consumption for biodiesel in Brazil in 2025, with over 85% of biodiesel inputs coming from soybean oil.

Risks and Volatility

In the USA, the replacement of the fixed $1 per gallon (40A) credit with the progressive 45Z credit, based on carbon intensity, reduced the competitiveness of soybean oil as an input for biomass diesel. This change has already led to a decline in production and demand, highlighting the direct impact of public policies on the market.

Protection Tools

With the appreciation and volatility of soybean oil, specific futures contracts and stock options for this commodity have emerged. These tools allow producers, processors, and investors to directly trade the oil's contribution to soybean value, offering protection against price fluctuations and greater precision in market decisions.

Conclusion

Soybean oil has moved from a supporting role to a central one in the energy transition. The new dynamics of domestic consumption, driven by biofuel policies, are reshaping the logic of soybean production and export.

Understanding this transformation is essential for those working in agribusiness and seeking to position themselves strategically in an increasingly complex and interconnected market.

The market is changing—and those who keep pace with this transformation with data and strategic vision will be ahead of the curve. Follow RGA for more analyses like this.

Credits for this article: Rio Grande Agricola and Open Markets - Click here to go to the CME Group article

Did you like this article? Leave a like and comment!

Comments