USDA Ignores Impact of Biodiesel and Lean Inventories from China.

- Vanderlei Cadore

- Jul 11, 2025

- 3 min read

USDA's July report adjusts corn and soybean stocks, but ignores decisive variables such as B15 in Brazil and China's strategic downsizing.

The United States Department of Agriculture (USDA) released this Friday (11) its new monthly supply and demand bulletin, bringing relevant adjustments to the numbers for the 2025/26 harvest. The highlight was the reduction in corn ending stocks and the increase in soybean stocks, while wheat data were also revised downwards.

Soybeans: Indicators for the 2025/26 Harvest

U.S. Soybeans - 2024/25 Crop

Production: reduced to 117.98 million tons.

Ending stocks: had a slight increase to 8.44 million tons.

Exports: down to 47.49 million tons.

Soybean crushing: had a slight increase to 69.13 million tons.

Planted area: remained at 33.79 million hectares.

Harvested area: with a slight adjustment to 33.39 million hectares.

South America

Brazil:

Production: maintained at 175 million tons.

Exports: maintained at 112 million tons.

Ending stocks: increased to 36.96 million tons.

Argentina:

Production: maintained at 48.50 million tons.

Exports: slight increase to 24.95 million tons.

Ending stocks: slight increase to 5 million tons.

China

Production: maintained at 21 million tons.

Imports: maintained at 112 million tons.

Ending stocks: reduction to 43.38 million tons.

World

Production: an increase to 427.68 million tons.

Ending stocks: an increase to 126.07 million tons.

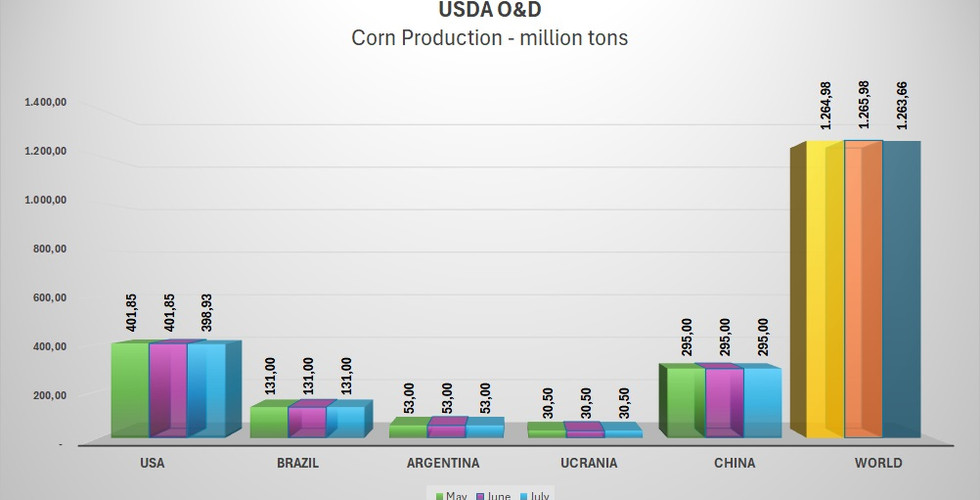

Corn: Indicators of the 2025/26 Harvest

US Corn - 2024/25 Crop

Production: reduced to 398.93 million tons.

Ending stocks: reduced to 42.17 million tons.

Exports: remained at 67.95 million tons.

Corn crushing: remained at 139.71 million tons.

Planted area: slight adjustment to 38.53 million hectares.

Harvested area: slight adjustment to 35.13 million hectares.

South America

Brazil:

Production: maintained at 131 million tons.

Exports: maintained at 43 million tons.

Ending stocks: minimum increase to 2.98 million tons.

Argentina:

Production: maintained at 50 million tons.

Exports: maintained at 36 million tons.

Ending stocks: increase to 3.59 million tons.

Ukraine

Production: maintained at 30.50 million tons.

Exports: maintained at 24 million tons.

Ending stocks: maintained at 0.60 million tons.

China

Production: maintained at 295 million tons.

Imports: maintained at 10 million tons.

Ending stocks: maintained at 179.16 million tons.

World

Production: reduction to 1,263.66 million tons.

Ending stocks: reduced to 272.08 million tons.

Although the USDA projects China's corn ending stocks at 179.16 million tons, a drop of 20 million from the beginning of the year, analysts point out that the country may be operating with leaner stocks by design. However, in view of the growing demand, a resumption of imports is not ruled out to rebalance the balance – which could surprise the market and pressure international prices.

Exclusive Note - Divergence in USDA Models

Despite the updated projections for corn, soybeans and wheat, the July USDA report did not incorporate a relevant factor in the Brazilian market: the increase in the mandatory biodiesel blend to 15% (B15), valid from August 2025.

The new policy should generate an additional demand of 1 billion liters of biodiesel, which represents about 5 million tons of soybeans more destined for crushing.

This data could directly influence the:

Soybean ending stocks in Brazil

Global vegetable oil projections

Brazilian grain export expectations

The absence of this adjustment in the USDA models raises doubts about the lag in the reading of Brazilian domestic demand.

Did you like this article? Share and like it!

Comments